Founder's Guide to U.S. Legal Entities & Taxes

A practical breakdown of business structures, tax implications, and why sole proprietorships aren’t worth the risk.

There’s a lot of confusion surrounding legal entities and tax structures in the U.S. If you’re a founder or thinking of starting a business, this week’s post breaks down the different types of legal entities, the taxes associated with each, and which structure is best suited for various purposes.

First, a quick note: I never recommend operating as a sole proprietor. Your tax ID in that case is your Social Security number, which you’ll need to share on W-9 forms with clients or customers. These forms are rarely handled securely, so your personal information could easily be exposed. Beyond that, sole proprietorships complicate tax filings and, most importantly, provide zero liability protection. If someone sues your business, your personal assets are fully at risk.

There’s plenty of debate around what early-stage startups need in terms of accounting, finance, and legal infrastructure. Many founders take pride in being scrappy and may view these formalities as unnecessary overhead. I understand that perspective, but every decision comes with associated risks. The headaches that come later often aren’t worth the short-term savings. Something as simple as forming an LLC using a service like LegalZoom (I’m not affiliated with them but I am a customer) takes just a few minutes and a one-time fee. It gives you legal protection and positions your business to grow more smoothly. To me, that’s an obvious yes.

If you’re new here, I recommend reading my post CPA vs. CFO, where I explain the differences between accounting and finance professionals and when to bring each one into your business.

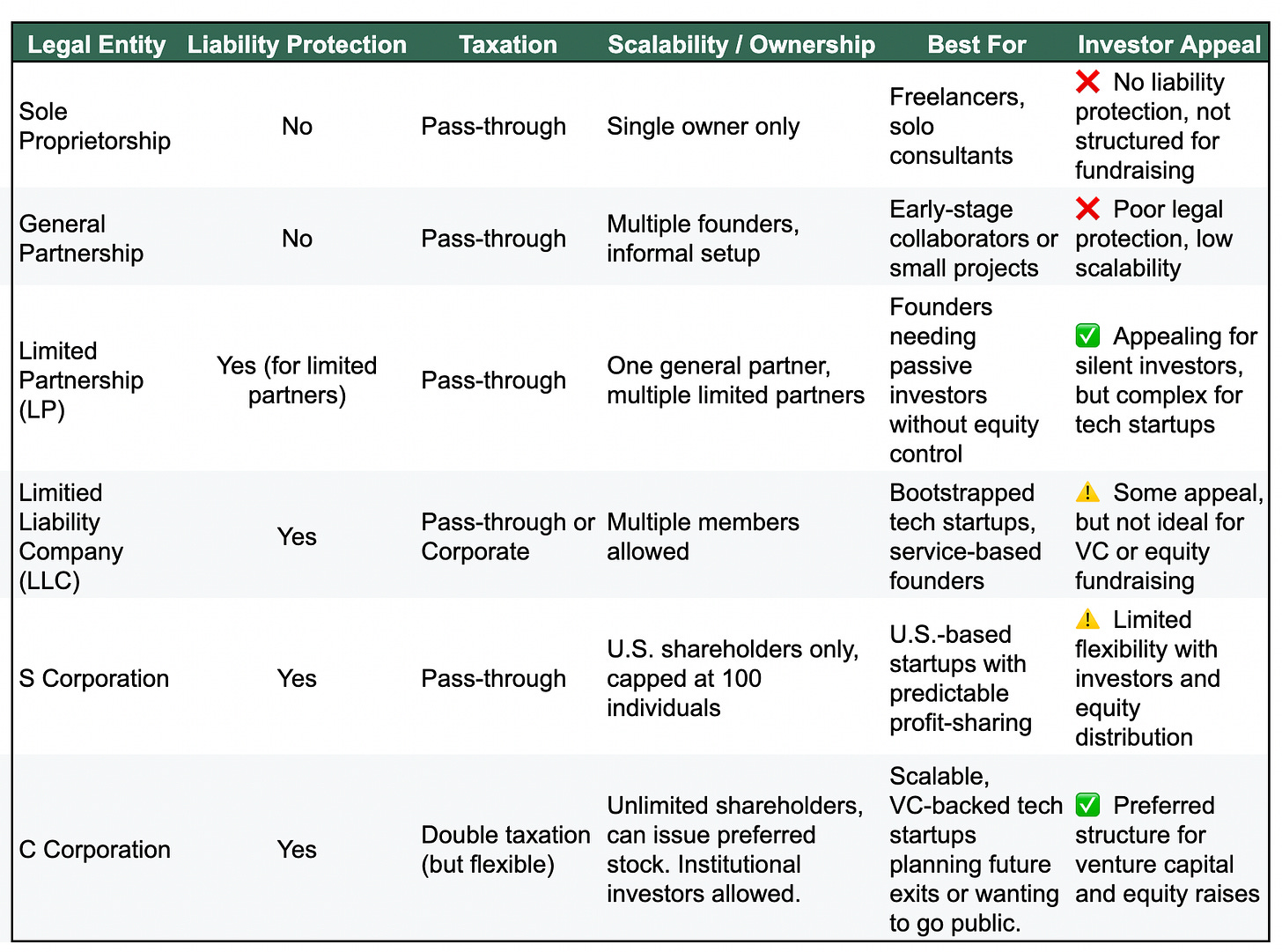

I created the following charts outlining the different types of legal entities in the United States, along with their liability and tax implications, ownership flexibility, and who they are best suited for (or not). Below the tables, you’ll find definitions for a few key terms mentioned in the chart for additional context.

For my international audience, if you plan on expanding to the U.S. market, this is a good place to start to familiarize yourself with different types of legal entities and what’s required from a compliance perspective. Of course, I personally respond to DMs, comments or the Chat if you have any questions.

Different Types of Legal Entities

KEY DEFINITIONS

Pass-through Entity: All income, deductions, and credits of the business are passed directly to the owners or partners. This means the business itself does not pay income taxes at the corporate level. Instead, profits or losses are reported on the individual tax returns of the owners, and taxes are paid at the individual level. Examples include sole proprietors, partnerships, S corporations and certain LLCs.

Liability Protection: Ensures that the owners’ personal assets (ex: their home, car or personal savings) are not at risk if the business incurs debts, losses, or lawsuits. Business entities like LLCs, corporations, and limited partnerships provide liability protection by separating the business’s financial obligations from the owners’ personal finances. Sole proprietorships and general partnerships do not offer this protection, meaning owners are personally responsible for business debts and liabilities.

Double Taxation: Double taxation occurs when the same income is taxed twice; once at the corporate level and again at the individual level. This typically applies to C corporations and happens in two stages:

Corporate Taxation: The corporation pays income taxes on its profits.

Individual Taxation: If the corporation distributes dividends to shareholders, those dividends are taxed again on the shareholders’ personal tax returns.

This differs from pass-through entities (ex: S corporations, LLCs electing pass-through taxation), where income is only taxed at the individual level, avoiding double taxation.

LLC Taxation Options

An LLC (Limited Liability Company) offers flexibility in how it is taxed. By default, a single-member LLC is taxed as a sole proprietorship, and a multi-member LLC is taxed as a partnership. In these cases, the LLC operated as a pass-through entity, meaning income and losses are passed through to the members and taxed at the individual level.

However, an LLC can elect to be taxed as a corporation by filing appropriate forms with the IRS. LLCs have the option to be taxed as:

C Corporation: Subject to corporation taxation (double taxation applies - taxes are paid at the corporate level and again on dividends at the individual level).

S Corporation: Subject to pass-through taxation but with stricter rules on ownership (ex: limited number of shareholders and no foreign ownership).

Pro Tip: Consider incorporating your legal entity in Delaware, even if you don’t live there or generate revenue in the state. You don’t need a physical address in Delaware to do this. Delaware is known for having the most founder, and investor-friendly, corporate laws in the U.S., offering strong legal protections and flexibility for shareholders. In fact, many venture capital firms require a Delaware C-Corp before they’ll invest.

Taxes by Legal Entity

Understanding tax obligations is critical when selecting a business structure. Here’s a breakdown of the main types of taxes and which legal entities are responsible for the various tax types.

Keep reading with a 7-day free trial

Subscribe to The Creative CFO to keep reading this post and get 7 days of free access to the full post archives.